Table of Contents

- Elizabeth Warren Wrote An 'Enough Is Enough' Op-Ed About The Wall ...

- Elizabeth Warren’s Greatest Strength Was Also Her Greatest Weakness ...

- Elizabeth Warren Raises Questions About Elon Musk and Twitter - The New ...

- Elizabeth Warren’s really not running for president — and other big ...

- Elizabeth Warren | Biography, Congress, Presidential Campaign, & Facts ...

- Elizabeth Warren Among New England's Unpopular Senators

- Elizabeth Warren causes DC freakout: Why the liberal hero has elite ...

- Elizabeth Warren Committee Announces Hires with Deep NH Experience ...

- Biography of Senator Elizabeth Warren, Senator and Scholar

- US senators rally behind labour groups urging China shipbuilding probe ...

The Threat of a Looming Crisis

The problem is that many of these companies are not using this debt to invest in their businesses or create new jobs. Instead, they're using it to enrich their shareholders and executives. This has created a situation where companies are taking on more debt than they can handle, making them vulnerable to even a slight increase in interest rates. If rates were to rise, many of these companies could find themselves unable to service their debt, leading to a wave of defaults and bankruptcies.

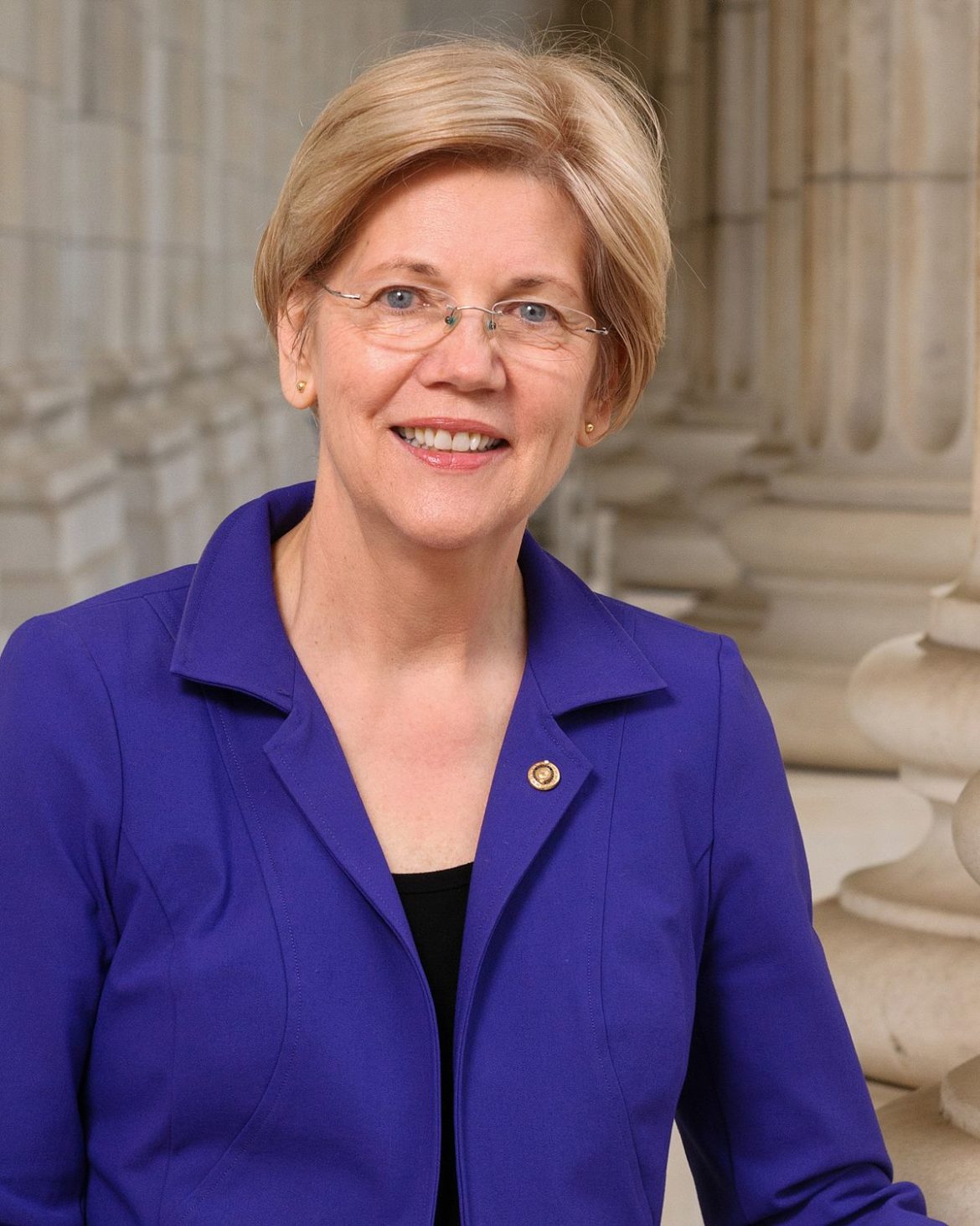

Elizabeth Warren's Plan to Prevent the Crisis

/GettyImages-1096613892-57bce17ef51845018064265e5771bfd9.jpg)

Warren's plan is not without its critics, however. Some argue that her proposals are too restrictive and could stifle economic growth. Others claim that the market can self-regulate and that government intervention is not necessary. However, Warren and her supporters argue that the risks are too great to ignore and that preventative measures are necessary to avoid another devastating crisis.

A Call to Action

The warning signs are clear: the financial system is vulnerable, and the consequences of inaction could be severe. It's time for policymakers to take heed of Senator Warren's warnings and take action to prevent the next financial crisis. This includes: Supporting stricter regulations on corporate debt and financial engineering practices Demanding greater transparency around corporate debt and financial dealings Urging policymakers to take a proactive approach to preventing the next crisisThe clock is ticking, and the consequences of inaction could be catastrophic. It's time to listen to Senator Warren's warnings and take action to prevent "the dumbest financial crisis ever." The future of the global economy depends on it.

Note: This article is for general information purposes only and should not be considered as investment advice.