Table of Contents

- Member FDIC. What Does that Mean for You As a Customer? - First ...

- The FDIC Facts Every Saver Should Know – Forbes Advisor

- What Is the FDIC and What Does It Mean to Me? - TheStreet

- Member FDIC. What Does that Mean for You As a Customer? - First ...

- FDIC Meaning - YouTube

- The FDIC’s Campaign Against Fintech Companies - WSJ

- FDIC Bank Closures: Is Your Money Safe? | Atlanta Daily World

- US bank regulator FDIC requests input on digital assets - Ledger ...

- FDIC Insurance: What Bank Products Are Covered & What's Not?

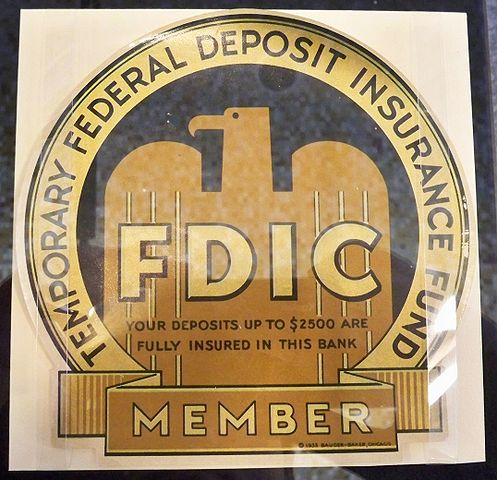

- The History of the FDIC and Its Role in Protecting Depositors

What is the FDIC?

How Does the FDIC Work?

Benefits of FDIC Insurance

The FDIC offers several benefits to depositors, including: Deposit protection: FDIC insurance protects depositors' funds up to $250,000 per depositor, per insured bank. Confidence and stability: The FDIC's presence helps maintain public confidence in the banking system, which is essential for a stable economy. Low-cost funding: The FDIC's deposit insurance allows banks to attract deposits at a lower cost, which can lead to lower interest rates on loans and higher interest rates on deposits. Consumer protection: The FDIC provides resources and support to help consumers make informed decisions about their banking and financial activities.